Description

The medical robots market is likely to expand quickly, with a compound annual growth rate (CAGR) of 15.7% from 2024 to 2031, when it is projected to be worth USD 45.021 billion. Numerous factors, including as the ageing population, the rise in chronic illness prevalence, the need for less invasive operations, and robotics technology improvements, are driving this market.

x Robots used in surgery, rehabilitation, telepresence, and other medical fields may fall under this category. Robotic minimally invasive surgery is becoming more and more popular worldwide, mostly because of its benefits: fewer cuts, smaller incisions, less discomfort, less scarring, increased safety, and faster recovery times.

Furthermore, by employing HD cameras to display microscopic structures, the techniques give the surgeons access to extremely sophisticated visualisation capabilities. Consequently, more control and more precision are guaranteed. The number of studies on rehabilitation robotics has increased, and the number of therapeutic rehabilitation robots has rapidly increased in the last few years.

Global Medical Robots Market: Covid-19 Impact

- Upheaval in the Supply Chain:

Global supply chains were disrupted by the COVID-19 pandemic, which had an impact on the manufacture and delivery of a variety of products, including medical robots. The manufacturing process and component availability may be impacted by supply chain delays.

- Growing Requirement for Robots with Telepresence:

The need for telepresence robots in healthcare settings may have increased due to the necessity of social distancing and minimising human touch. By enabling remote patient interaction, these robots lower the danger of exposure for medical personnel.

- Effects on Development and Research:

The pandemic might have had an impact on medical robots research and development efforts. In order to attend to the urgent healthcare demands brought on by the pandemic, certain projects may have been postponed or reorganised.

Global Medical Robots Market: Growth Drivers

- Growing Population Ageing:

The necessity for surgical treatments and the incidence of chronic diseases are frequently correlated with the ageing population on a worldwide scale. The market is expanding as a result of the growing use of medical robots in surgeries and other medical operations.

- Technological Progress:

The uses of medical robots have increased due to ongoing breakthroughs in robotic technology, which have included increases in dexterity, precision, and the incorporation of artificial intelligence (AI). This has accelerated the use of robotic technology in the medical domain.

- Growing Need for Surgery That Is Less Invasive:

Medical robots are essential to minimally invasive operations because they provide advantages such shorter recovery periods, less chance of infection, and less scarring. The increasing preference for minimally invasive surgery has driven the demand for robotic-assisted surgical systems.

Global Medical Robots Market: Restraining factors

- High starting expenses:

Buying and deploying medical robotic systems can come with a significant upfront cost. This element may restrict the uptake of these technologies, especially in medical facilities that are operating on a tight budget.

- Limited Reimbursement Policies:

In certain areas, the lack of comprehensive reimbursement policies may prevent medical robotic procedures from being widely adopted. Healthcare providers may be reluctant to invest in robotic systems without clear reimbursement pathways.

Global Medical Robots Market: Opportunity Factors

- Growing Number of Surgical Procedures:

Medical robots have an enormous opportunity as the number of surgical procedures—especially minimally invasive surgeries—increases. The use of robotic-assisted surgical systems is being driven by the need for less invasive and precise procedures.

- Technological Progress:

More advanced and effective medical robotic systems are possible thanks to ongoing technological developments in the fields of artificial intelligence (AI), machine learning, and robotics.

- Increasing Utilisation:

There are now more opportunities for market expansion as robotic applications are being used in a wider range of medical specialties, including neurology, cardiology, and orthopedics. The increasing versatility of robotic systems is leading to their increased adoption in various medical fields.

Global Medical Robots Market: Challenges

- Restricted Availability in Developing Areas:

In certain developing nations, medical robots may not be easily available or reasonably priced, which could result in differences in the uptake of new technologies between developed and developing healthcare systems.

- Opposition to Change:

Medical robot integration into current workflows can be hampered by resistance to change within healthcare organisations, including reluctance among surgeons and medical staff to adopt new technologies.

- Legal and Ethical Concerns:

The widespread use of medical robots is hampered by ethical concerns about patient privacy, data security, and liability in the event of a system failure.

Global Medical Robots Market: Segmentation

By type, market is segmented into external large robots, miniature in vivo robots geriatric robots, and assistive robots.

By end-user market is segmented into hospitals, specialty clinics, research institutes, laboratories, rehabilitation centers, ambulatory surgical centers, others.

- Outside Big Robots:

These are big robots that are utilised outside for different medical purposes. They are frequently used in diagnostic imaging, surgery, and other medical treatments. Robotic surgical systems such as the da Vinci Surgical System are among the examples.

- Robots In Vivo Miniatures:

In vivo miniature robots are made to function inside the human body. They are often used for minimally invasive procedures, such as endoscopic surgeries or interventions in difficult-to-reach areas. In confined areas, these robots are capable of precise control and navigation.

- Particularty Clinics:

Medical robots customised to their specific requirements may be used in specialty clinics that concentrate on particular medical specialties (such as neurology or orthopaedics).

- Research Establishments:

Research centres are essential to the creation and evaluation of medical robots. Robots may be used by these institutions for data collection, experimental surgery, and the advancement of medical robotics technologies.

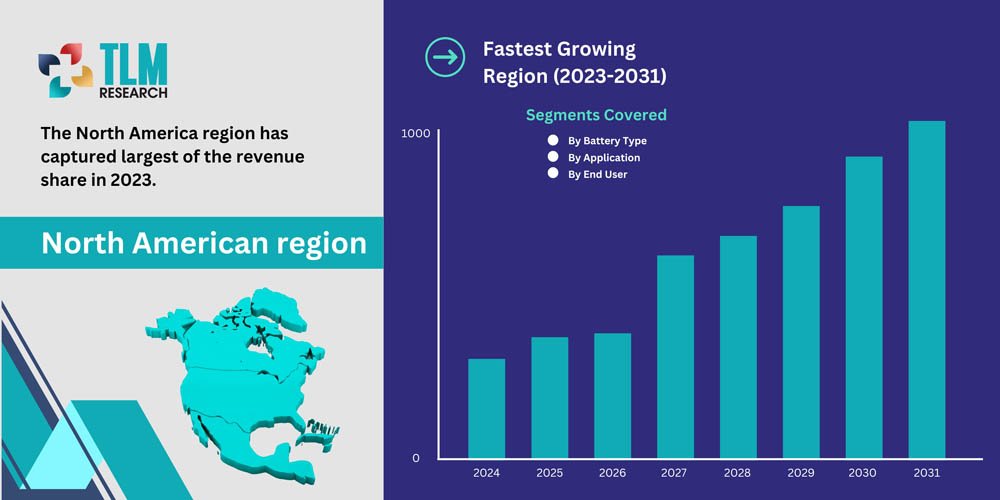

Global Medical Robots Market: Regional Insights

- North America: With more than 50% of the revenue expected in the medical robots market worldwide in 2022, North America commands the largest share of the market. This is brought about by the existence of well-known medical device manufacturers, high healthcare costs, and early adoption of cutting-edge technologies.

- Europe: With a sizeable portion of the global revenue, Europe is the second-largest market for medical robots. Several significant companies in the medical robotics sector, including Siemens Healthineers, Medtronic, and Intuitive Surgical, are based in the area.

- Asia Pacific: Over the course of the forecast period, the medical robots market is anticipated to grow at the fastest rate in this region. The growing middle class, rising disposable incomes, and developing healthcare system are to blame for this.

- Latin America: Although the region’s medical robots market is still in its infancy, over the course of the forecast period, it is anticipated to grow at a compound annual growth rate of more than 10%. The increasing use of minimally invasive procedures and the rising acceptance of robotic surgery are the main drivers of this growth.

Global Medical Robots Market: Key market players

- Intuitive Surgical (U.S.)

- Medtronic (Ireland)

- Johnson & Johnson (U.S.)

- Abbott Laboratories (U.S.)

- Siemens Healthineers (Germany)

- Getinge (Sweden)

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Smith & Nephew (U.K.)

- Terumo (Japan)

Global Medical Robots Market: Recent Developments

The FDA approved Intuitive Surgical’s Da Vinci Xi Surgical System in December 2022 for use in transoral robotic surgery (TORS). TORS is a minimally invasive surgical method that allows for surgery through the nose or mouth using an endoscope that is controlled by a robot. It is anticipated that the clearance will enable the Da Vinci Xi Surgical System to be used for more procedures.

Johnson & Johnson declared in August 2022 that its Monarch platform for transcatheter mitral valve repair (TMVR) would go on sale. A catheter is used in TMVR, a minimally invasive procedure, to fix a leaky mitral valve. The FDA has approved the Monarch platform as the first TMVR system.