1. EXECUTIVE SUMMARY

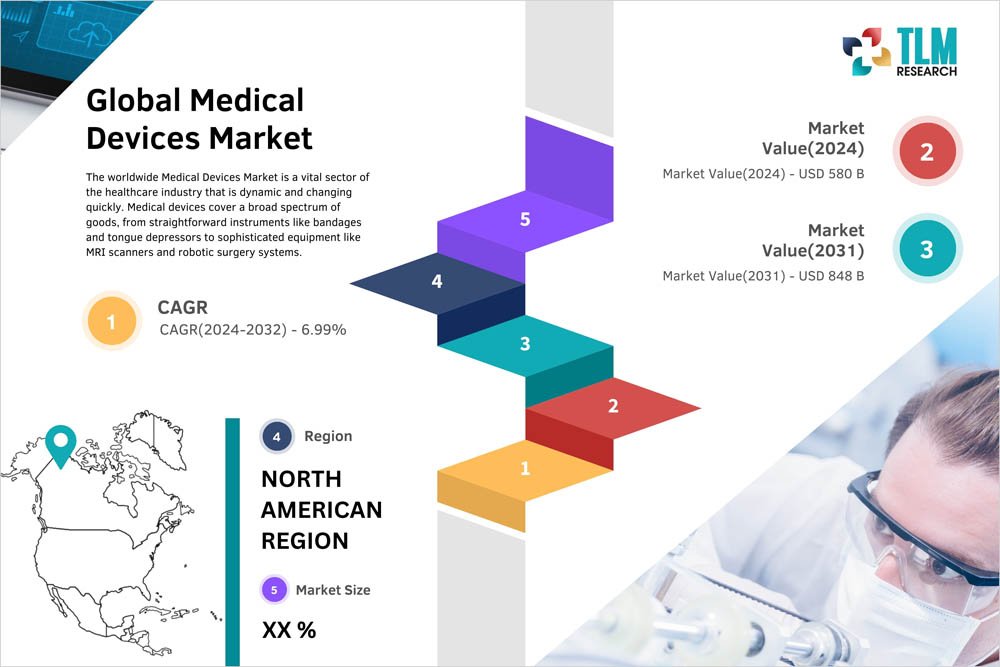

1.1. Summary

2. PREMIUM INSIGHTS

2.1. Growth Lens Perspective of CXO’s on the Market

2.2. Untapped Revenue Opportunities

2.3. Top Investment Pockets

2.4. Insights From Expert Interviews

2.5. Market Scenarios: Pessimistic vs. Optimistic vs. Realistic

2.6. Absolute Market Opportunity

2.7. Takeaways and Strategic Conclusions

2.8. Revenue Shift

2.9. Business Model Canva

3. RESEARCH METHODOLOGY

3.1. Research Process

3.2. Primary Research

3.3. Secondary Research

3.4. Market Size Estimation

3.5. Research Methodology

3.6. Analyst Tools/Models/Techniques

3.6.1. Notations

3.7. Market Scope & Segmentation

3.8. Currency & Pricing Considered

4. MARKET TRENDS

4.1. Introduction

4.2. Drivers

4.2.1. Rising Prevalence of Chronic Diseases to Surge the Demand for Medical Devices

4.2.2. Shift toward Homecare Settings to Increase the Demand for Portable Devices

4.2.3. Emerging Markets and Healthcare Access

4.2.4. Increased Healthcare Spending

4.3. Restraints

4.3.1. High Cost of Devices and Inadequate Reimbursement Policies in Emerging Countries

4.3.2. Stringent Regulatory Approval Process

4.4. Opportunities

4.4.1. Telehealth and Remote Patient Monitoring

4.4.2. Point-of-Care Testing

4.5. Investment Feasibility Analysis

4.6. Latest Trends

4.6.1. Growing Customer Preference for Wearable Devices to Propel Industry Expansion

5. MARKET ASSESSMENT

5.1. Porters Five Forces Analysis

5.1.1. Bargaining Power of Suppliers

5.1.2. Bargaining Power of Buyers

5.1.3. Threat of New Entrants

5.1.4. Threat of Substitute

5.1.5. Intensity of Competitive Rivalry

5.2. Value Chain Analysis

5.3. Impact of Key Regulations on the Market

5.4. SWOT Analysis

5.5. PESTEL Analysis

5.6. Supply Chain Analysis

5.7. Patent Analysis

5.7.1. By Innovator

5.7.2. By Applicant

5.7.3. By Country

5.8. Roadmap Development

5.9. Market Lineage Outlook

5.9.1. Parent Market Outlook

5.9.2. Ancillary Market Outlook

5.10. Future Perspective

6. IMPACT OF RECESSION ON THE MARKET

6.1. Introduction

6.1.1. Short Term Impact

6.1.2. Long Term Impact

7. IMPACT OF COVID-19 ON THE MARKET

7.1. Deferral of Elective Procedures Hampered Market Growth amid Coronavirus

8. GLOBAL MEDICAL DEVICES MARKET, BY PRODUCT

8.1. Introduction

8.1.1. Market Size & Forecast

8.1.2. Global Medical Devices Market Share, by Product -2024 and 2031 (%)

8.2. Cardiac Monitoring Devices

8.2.1. Key market Trends, Growth Factors, and Opportunities

8.2.2. Market Size and Forecast, by Regions

8.3. Neuromonitoring Devices

8.3.1. Key market Trends, Growth Factors, and Opportunities

8.3.2. Market Size and Forecast, by Regions

8.4. Respiratory Monitoring Devices

8.4.1. Key market Trends, Growth Factors, and Opportunities

8.4.2. Market Size and Forecast, by Regions

8.5. Multi-Parameter Monitoring Devices

8.5.1. Key market Trends, Growth Factors, and Opportunities

8.5.2. Market Size and Forecast, by Regions

8.6. Hemodynamic Monitoring Devices

8.6.1. Key market Trends, Growth Factors, and Opportunities

8.6.2. Market Size and Forecast, by Regions

8.7. Fetal and Neonatal Monitoring Devices

8.7.1. Key market Trends, Growth Factors, and Opportunities

8.7.2. Market Size and Forecast, by Regions

8.8. Temperature Monitoring Devices

8.8.1. Key market Trends, Growth Factors, and Opportunities

8.8.2. Market Size and Forecast, by Regions

8.9. Weight Monitoring Devices

8.9.1. Key market Trends, Growth Factors, and Opportunities

8.9.2. Market Size and Forecast, by Regions

8.10. Diagnostic Devices

8.10.1. Key market Trends, Growth Factors, and Opportunities

8.10.2. Market Size and Forecast, by Regions

8.11. Surgical ENT Devices

8.11.1. Key market Trends, Growth Factors, and Opportunities

8.11.2. Market Size and Forecast, by Regions

8.12. Endoscopes

8.12.1. Key market Trends, Growth Factors, and Opportunities

8.12.2. Market Size and Forecast, by Regions

8.13. Imaging Devices

8.13.1. Key market Trends, Growth Factors, and Opportunities

8.13.2. Market Size and Forecast, by Regions

8.14. Diagnostic Molecular Devices

8.14.1. Key market Trends, Growth Factors, and Opportunities

8.14.2. Market Size and Forecast, by Regions

8.15. Drug Delivery Devices

8.15.1. Key market Trends, Growth Factors, and Opportunities

8.15.2. Market Size and Forecast, by Regions

8.16. Surgical Devices

8.16.1. Key market Trends, Growth Factors, and Opportunities

8.16.2. Market Size and Forecast, by Regions

8.17. Bio Implants and Stimulation Devices

8.17.1. Key market Trends, Growth Factors, and Opportunities

8.17.2. Market Size and Forecast, by Regions

8.18. Treatment Equipment

8.18.1. Key market Trends, Growth Factors, and Opportunities

8.18.2. Market Size and Forecast, by Regions

8.19. Infusion Pumps

8.19.1. Key market Trends, Growth Factors, and Opportunities

8.19.2. Market Size and Forecast, by Regions

8.20. Medical lasers and LASIK surgical machines

8.20.1. Key market Trends, Growth Factors, and Opportunities

8.20.2. Market Size and Forecast, by Regions

8.21. Electronic Medical Device

8.21.1. Key market Trends, Growth Factors, and Opportunities

8.21.2. Market Size and Forecast, by Regions

8.22. Others

8.22.1. Key market Trends, Growth Factors, and Opportunities

8.22.2. Market Size and Forecast, by Regions

9. GLOBAL MEDICAL DEVICES MARKET, BY THERAPEUTIC APPLICATION

9.1. Introduction

9.1.1. Market Size & Forecast

9.1.2. Global Medical Devices Market Share, by Therapeutic Application -2024 and 2031 (%)

9.2. Gastrointestinal surgery

9.2.1. Key market Trends, Growth Factors, and Opportunities

9.2.2. Market Size and Forecast, by Regions

9.3. General Surgery

9.3.1. Key market Trends, Growth Factors, and Opportunities

9.3.2. Market Size and Forecast, by Regions

9.4. Diagnostic Imaging

9.4.1. Key market Trends, Growth Factors, and Opportunities

9.4.2. Market Size and Forecast, by Regions

9.5. Respiratory

9.5.1. Key market Trends, Growth Factors, and Opportunities

9.5.2. Market Size and Forecast, by Regions

9.6. Orthopedics

9.6.1. Key market Trends, Growth Factors, and Opportunities

9.6.2. Market Size and Forecast, by Regions

9.7. Cardiovascular

9.7.1. Key market Trends, Growth Factors, and Opportunities

9.7.2. Market Size and Forecast, by Regions

9.8. Dental

9.8.1. Key market Trends, Growth Factors, and Opportunities

9.8.2. Market Size and Forecast, by Regions

9.9. Neurology

9.9.1. Key market Trends, Growth Factors, and Opportunities

9.9.2. Market Size and Forecast, by Regions

9.10. Ophthalmology

9.10.1. Key market Trends, Growth Factors, and Opportunities

9.10.2. Market Size and Forecast, by Regions

9.11. Ear-Nose-Throat (ENT)

9.11.1. Key market Trends, Growth Factors, and Opportunities

9.11.2. Market Size and Forecast, by Regions

9.12. Nephrology and Urology

9.12.1. Key market Trends, Growth Factors, and Opportunities

9.12.2. Market Size and Forecast, by Regions

9.13. Others

9.13.1. Key market Trends, Growth Factors, and Opportunities

9.13.2. Market Size and Forecast, by Regions

10. GLOBAL MEDICAL DEVICES MARKET, BY END USER

10.1. Introduction

10.1.1. Market Size & Forecast

10.1.2. Global Medical Devices Market Share, by End User -2024 and 2031 (%)

10.2. Hospitals & Clinics

10.2.1. Key market Trends, Growth Factors, and Opportunities

10.2.2. Market Size and Forecast, by Regions

10.3. Diagnostic Centers

10.3.1. Key market Trends, Growth Factors, and Opportunities

10.3.2. Market Size and Forecast, by Regions

10.4. Research laboratory

10.4.1. Key market Trends, Growth Factors, and Opportunities

10.4.2. Market Size and Forecast, by Regions

10.5. Pharmaceutical companies

10.5.1. Key market Trends, Growth Factors, and Opportunities

10.5.2. Market Size and Forecast, by Regions

10.6. Others

10.6.1. Key market Trends, Growth Factors, and Opportunities

10.6.2. Market Size and Forecast, by Regions

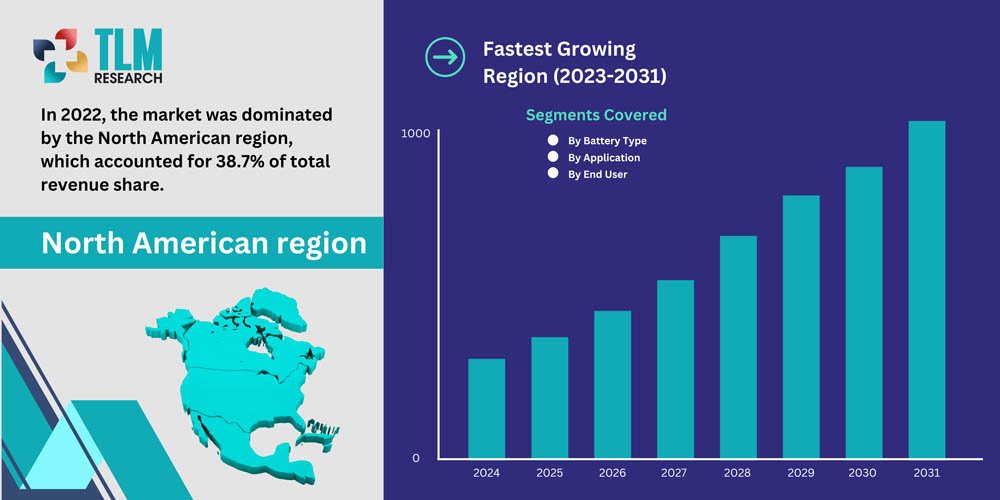

11. NORTH AMERICA MARKET ANALYSIS

11.1. Introduction

11.2. Medical Devices Market by Country

11.2.1. North America Medical Devices Market by Country, USD Billion 2019-2031

11.3. Market Size & Forecast, by Product

11.4. Market Size & Forecast, by Therapeutic Application

11.5. Market Size & Forecast, by End User

11.6. U.S.

11.6.1. Market Size & Forecast, by Product

11.6.2. Market Size & Forecast, by Therapeutic Application

11.6.3. Market Size & Forecast, by End User

11.7. Canada

11.7.1. Market Size & Forecast, by Product

11.7.2. Market Size & Forecast, by Therapeutic Application

11.7.3. Market Size & Forecast, by End User

12. EUROPE MARKET ANALYSIS

12.1. Introduction

12.2. Medical Devices Market by Country

12.2.1. Europe Medical Devices Market by Country, USD Billion 2019-2031

12.3. Market Size & Forecast, by Product

12.4. Market Size & Forecast, by Therapeutic Application

12.5. Market Size & Forecast, by End User

12.6. Germany

12.6.1. Market Size & Forecast, by Product

12.6.2. Market Size & Forecast, by Therapeutic Application

12.6.3. Market Size & Forecast, by End User

12.7. France

12.7.1. Market Size & Forecast, by Product

12.7.2. Market Size & Forecast, by Therapeutic Application

12.7.3. Market Size & Forecast, by End User

12.8. U.K

12.8.1. Market Size & Forecast, by Product

12.8.2. Market Size & Forecast, by Therapeutic Application

12.8.3. Market Size & Forecast, by End User

12.9. Italy

12.9.1. Market Size & Forecast, by Product

12.9.2. Market Size & Forecast, by Therapeutic Application

12.9.3. Market Size & Forecast, by End User

12.10. Spain

12.10.1. Market Size & Forecast, by Product

12.10.2. Market Size & Forecast, by Therapeutic Application

12.10.3. Market Size & Forecast, by End User

12.11. Benelux

12.11.1. Market Size & Forecast, by Product

12.11.2. Market Size & Forecast, by Therapeutic Application

12.11.3. Market Size & Forecast, by End User

12.12. Rest of Europe

12.12.1. Market Size & Forecast, by Product

12.12.2. Market Size & Forecast, by Therapeutic Application

12.12.3. Market Size & Forecast, by End User

13. ASIA-PACIFIC MARKET ANALYSIS

13.1. Introduction

13.2. Medical Devices Market by Country

13.2.1. Asia Pacific Medical Devices Market by Country, USD Billion 2019-2031

13.3. Market Size & Forecast, by Product

13.4. Market Size & Forecast, by Therapeutic Application

13.5. Market Size & Forecast, by End User

13.6. China

13.6.1. Market Size & Forecast, by Product

13.6.2. Market Size & Forecast, by Therapeutic Application

13.6.3. Market Size & Forecast, by End User

13.7. India

13.7.1. Market Size & Forecast, by Product

13.7.2. Market Size & Forecast, by Therapeutic Application

13.7.3. Market Size & Forecast, by End User

13.8. Japan

13.8.1. Market Size & Forecast, by Product

13.8.2. Market Size & Forecast, by Therapeutic Application

13.8.3. Market Size & Forecast, by End User

13.9. Australia

13.9.1. Market Size & Forecast, by Product

13.9.2. Market Size & Forecast, by Therapeutic Application

13.9.3. Market Size & Forecast, by End User

13.10. South Korea

13.10.1. Market Size & Forecast, by Product

13.10.2. Market Size & Forecast, by Therapeutic Application

13.10.3. Market Size & Forecast, by End User

13.11. Southeast Asia

13.11.1. Market Size & Forecast, by Product

13.11.2. Market Size & Forecast, by Therapeutic Application

13.11.3. Market Size & Forecast, by End User

13.12. Rest of Asia Pacific

13.12.1. Market Size & Forecast, by Product

13.12.2. Market Size & Forecast, by Therapeutic Application

13.12.3. Market Size & Forecast, by End User

14. LATIN AMERICA AND THE CARIBBEAN MARKET ANALYSIS

14.1. Introduction

14.2. Medical Devices Market by Country

14.2.1. Latin America Medical Devices Market by Country, USD Billion 2019-2031

14.3. Market Size & Forecast, by Product

14.4. Market Size & Forecast, by Therapeutic Application

14.5. Market Size & Forecast, by End User

14.6. Brazil

14.6.1. Market Size & Forecast, by Product

14.6.2. Market Size & Forecast, by Therapeutic Application

14.6.3. Market Size & Forecast, by End User

14.7. Mexico

14.7.1. Market Size & Forecast, by Product

14.7.2. Market Size & Forecast, by Therapeutic Application

14.7.3. Market Size & Forecast, by End User

14.8. Rest of Latin America

14.8.1. Market Size & Forecast, by Product

14.8.2. Market Size & Forecast, by Therapeutic Application

14.8.3. Market Size & Forecast, by End User

15. THE MIDDLE EAST AND AFRICA MARKET ANALYSIS

15.1. Introduction

15.2. Medical Devices Market by Country

15.2.1. MEA Medical Devices Market by Country, USD Billion 2019-2031

15.3. Market Size & Forecast, by Product

15.4. Market Size & Forecast, by Therapeutic Application

15.5. Market Size & Forecast, by End User

15.6. South Africa

15.6.1. Market Size & Forecast, by Product

15.6.2. Market Size & Forecast, by Therapeutic Application

15.6.3. Market Size & Forecast, by End User

15.7. Saudi Arabia

15.7.1. Market Size & Forecast, by Product

15.7.2. Market Size & Forecast, by Therapeutic Application

15.7.3. Market Size & Forecast, by End User

15.8. UAE

15.8.1. Market Size & Forecast, by Product

15.8.2. Market Size & Forecast, by Therapeutic Application

15.8.3. Market Size & Forecast, by End User

15.9. Rest of MEA

15.9.1. Market Size & Forecast, by Product

15.9.2. Market Size & Forecast, by Therapeutic Application

15.9.3. Market Size & Forecast, by End User

16. COMPETITIVE LANDSCAPE

16.1. Introduction

16.2. Market Share Analysis

16.2.1. Market Opportunity for Company

16.2.2. Market Positioning Analysis

16.2.3. Market Share, By Company

16.3. Market Player Positioning, 2022

16.4. Company Evaluation Matrix

16.5. Product Mapping of Top 10 Player

16.6. Market Opportunities and Future Trends

16.7. Competitive Heatmap

16.8. Top Winning Growth Strategies

16.8.1. Major Growth Strategies

16.8.2. Expansion

16.8.3. Merger and Acquisition

16.8.4. Other Developments

17. COMPANY PROFILES

17.1. Medtronic Plc (Ireland)

17.1.1. Company Overview

17.1.2. Key Executives

17.1.3. Financial Overview

17.1.4. Business Segment Analysis

17.1.5. Product Portfolio

17.1.6. Key Strategic Developments

17.2. Stryker (U.S.)

17.3. Johnson & Johnson Services, Inc. (U.S.)

17.4. Fresenius SE & Co. KGaA (Germany)

17.5. Koninklijke Philips N.V. (Netherlands)

17.6. Abbott (U.S.)

17.7. General Electric Company (U.S.)

17.8. Siemens Healthineers AG (Germany)

17.9. BD (U.S.)

17.10. Cardinal Health (U.S.)

17.11. Others

18. APPENDIX

18.1. DISCUSSION GUIDE

18.2. Company Outlook