Description

Digital transformation in healthcare refers to the integration and adoption of digital technologies to enhance the quality of healthcare services, improve patient outcomes, and streamline healthcare processes. This transformation involves the use of various technologies, including telehealth, electronic health records (EHR), mobile health (mHealth), artificial intelligence (AI), and other digital solutions.

Remote healthcare services, virtual consultations, and telemonitoring. Enables patients to access medical care from a distance, improving accessibility and reducing the need for in-person visits. Enhances coordination among healthcare providers and facilitates data-driven decision-making. Includes health and fitness apps, remote patient monitoring, and medication adherence tools. Improves the efficiency of healthcare processes and aids in medical research.

Global Digital Transformation in the Healthcare Market: Covid-19 Impact

The need for social distancing and reducing the risk of virus transmission led to a surge in telehealth and telemedicine services. Telehealth allows healthcare providers to conduct virtual consultations, monitor patients remotely, and deliver care without physical contact. The pandemic highlighted the importance of remote patient monitoring technologies, enabling healthcare providers to keep track of patients’ vital signs and health metrics from a distance.

Wearable devices and IoT technologies have become essential for monitoring COVID-19 patients and those with chronic conditions. Digital tools played a crucial role in tracking and managing the spread of the virus.

Contact tracing apps, online symptom checkers, and digital platforms for vaccine distribution were implemented to enhance public health efforts. Advanced analytics, including artificial intelligence and machine learning, were employed for predictive modeling and data analysis. These technologies helped in forecasting the spread of the virus, managing healthcare resources, and optimizing treatment strategies.

Global Digital Transformation in the Healthcare Market: Growth Drivers

- Technological Advancements:

Continuous advancements in technology, such as artificial intelligence, machine learning, and the Internet of Things (IoT), provide new and innovative solutions for healthcare challenges. Emerging technologies enhance diagnostics, treatment planning, and overall healthcare efficiency.

- Increased Healthcare Data Availability:

The growing availability of digital health data, including electronic health records (EHRs) and patient-generated data, provides a rich source of information for improving patient care and outcomes. Data-driven insights support personalized medicine and evidence-based decision-making.

- Consumer Demand for Digital Health Services:

Rising consumer expectations for convenient and accessible healthcare services drive the demand for digital health solutions. Telehealth and mobile health applications allow patients to access healthcare services remotely, promoting patient engagement and satisfaction.

Global Digital Transformation in the Healthcare Market: Restraining factors

- Security Concerns:

The healthcare industry deals with sensitive patient data, making security a top priority. Concerns about data breaches, cyber-attacks, and the potential compromise of patient information can slow down the adoption of digital technologies.

- Regulatory Compliance:

Stringent regulations and compliance requirements, such as HIPAA (Health Insurance Portability and Accountability Act) in the United States, can pose challenges for healthcare organizations aiming to implement digital solutions. Navigating complex regulatory frameworks may slow down the adoption of new technologies.

- Interoperability Issues:

Healthcare systems often use a variety of legacy systems that may not be compatible with new digital solutions. Achieving interoperability between different systems and platforms is a significant challenge, as it requires seamless data exchange across various healthcare IT systems.

Global Digital Transformation in the Healthcare Market: Opportunity Factors

- Improved Patient Care and Outcomes:

Digital technologies enable healthcare providers to access and analyze patient data more efficiently, leading to better-informed decision-making, personalized treatment plans, and ultimately improved patient outcomes.

- Telemedicine and Remote Patient Monitoring:

The expansion of telemedicine allows for remote consultations and monitoring, improving access to healthcare services, especially in underserved or remote areas. Remote patient monitoring can enhance the management of chronic conditions and contribute to preventive care.

- Efficiency and Cost Savings:

Digital transformation can streamline administrative processes, reduce paperwork, and optimize workflows. This leads to increased operational efficiency and cost savings for healthcare organizations, allowing resources to be allocated more effectively.

Global Digital Transformation in the Healthcare Market: Challenges

- Interoperability Issues:

Healthcare systems often use different technologies and standards, leading to challenges in sharing and exchanging data seamlessly between systems. Lack of interoperability can hinder the flow of information and coordination of care across different healthcare entities.

- Data Security and Privacy Concerns:

Healthcare organizations deal with sensitive patient data, and ensuring the security and privacy of this information is paramount. The risk of data breaches, cyberattacks, and unauthorized access poses a significant challenge to the widespread adoption of digital technologies in healthcare.

- Regulatory Compliance:

The healthcare industry is subject to strict regulations and compliance requirements, such as HIPAA in the United States and GDPR in Europe. Adhering to these regulations while implementing new digital solutions can be complex and time-consuming.

Global Digital Transformation in the Healthcare Market: Segmentation

By End-Users the market is segmented into Providers, Payers, and Patients. Healthcare providers, including hospitals, clinics, and individual healthcare practitioners, are crucial end-users of digital transformation technologies. These technologies can include electronic health records (EHRs), telemedicine solutions, diagnostic tools, and other systems that enhance patient care and streamline healthcare delivery.

By Application, the market is segmented into Clinical Applications, Administrative Applications, and Operational Applications. Administrative applications are designed to streamline the operational and administrative aspects of healthcare organizations. This may involve the use of digital solutions for scheduling, billing, claims processing, inventory management, and other administrative tasks to enhance efficiency and reduce paperwork.

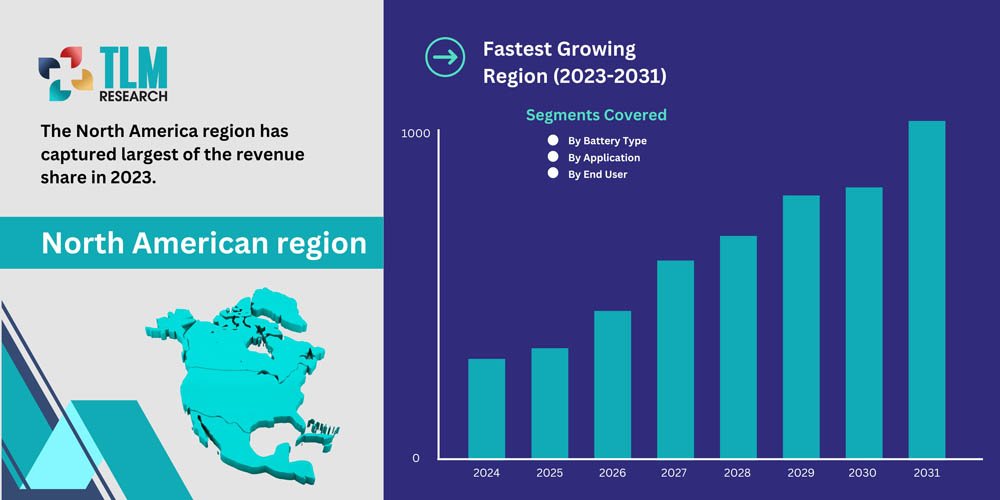

Global Digital Transformation in the Healthcare Market: Regional Insights

- North America: The United States and Canada have been at the forefront of adopting digital health technologies. The push for electronic health records (EHRs) and the implementation of telemedicine solutions have gained traction. However, the complexity of the healthcare system and diverse regulatory landscapes can present challenges.

- Europe: European countries have made strides in digital healthcare adoption, with a focus on interoperability and data exchange between member states. The European Union’s General Data Protection Regulation (GDPR) influences how health data is managed. Countries like Germany and the United Kingdom have been actively investing in digital health infrastructure.

- Asia-Pacific: The Asia-Pacific region is experiencing rapid digital transformation in healthcare, driven by technological advancements and the increasing demand for healthcare services. Countries like China, India, and Japan are investing heavily in digital health initiatives, including telehealth, health information exchange, and electronic medical records.

- Latin America: Digital health adoption in Latin America varies across countries. Brazil and Mexico, as larger economies, have seen advancements in health IT infrastructure. Telemedicine is gaining popularity in addressing healthcare accessibility challenges, while regulatory frameworks are evolving.

- Middle East and Africa: The adoption of digital health technologies in the Middle East is growing, with countries like the United Arab Emirates investing in healthcare innovation. In Africa, challenges related to infrastructure and access to technology persist, but there is a growing interest in leveraging digital solutions for healthcare delivery.

Global Digital Transformation in the Healthcare Market: Key market players

- Microsoft Corporation

- IBM Corporation

- SAP SE

- Dell EMC

- Accenture PLC

- Cognizant Technology Solutions

- CA Technologies

- Adobe Systems

- Hewlett Packard Enterprise