Description

Global Diabetes Control Devices Market: Market Overview

The Diabetes Control Devices Market size was USD 32.01 Billion in 2022. COVID -19 impact remains positive on the diabetes control devices market. This was owing to patients with different health issues, including diabetes and high blood pressure being at higher risk of getting infected by this virus. The mortality rate was high in patients with diabetes compared to the general population.

People with diabetes require continuous access to insulin (administrated with syringes or pens) and care. Thus, the adoption of insulin pens and continuous glucose monitoring devices increased the demand for close monitoring and optimal management of diabetes. Between 2023 and 2031, the market is projected to grow at a CAGR of 6.5%, from USD 34.08 billion in 2023 to USD 56.40 billion in 2031. The sudden rise in CAGR is attributed to this market growth returning to the pre-pandemic level once the pandemic is over.

Global Diabetes Control Devices Market: Market Scope and Definition

The Diabetes Control Devices Market refers to the comprehensive industry dedicated to developing, manufacturing, and providing devices designed to assist individuals in managing diabetes effectively. These devices encompass a wide range of tools that play critical roles in monitoring blood glucose levels and administering insulin, essential components in diabetes care.

Blood glucose monitoring devices, including self-monitoring blood glucose (SMBG) meters and continuous glucose monitoring (CGM) systems, enable patients to track and regulate their blood sugar levels. Insulin delivery devices, such as insulin pens and pumps, facilitate the controlled administration of insulin, a vital hormone for individuals with diabetes.

The market scope extends to various distribution channels, including hospital and retail pharmacies, online pharmacies, and diabetes clinics, ensuring accessibility for patients across diverse settings. With applications spanning Type 1 and Type 2 diabetes, as well as gestational diabetes, the market addresses the distinct needs of different patient groups. For instance,

In March 2023, Abbott reported that the U.S. Food and Drug Administration had granted clearance for the integration of its FreeStyle Libre 2 and FreeStyle Libre 3 continuous glucose monitoring system sensors with automated insulin delivery (AID) systems. Abbott adjusted the sensors, allowing seamless incorporation into AID systems.

Global Diabetes Control Devices Market: Market Drivers

Rising Prevalence of Diabetes Globally is Fueling the Demand to Aid Growth Drives the Market Growth

The global rise in diabetes prevalence, particularly in developing nations like China and India, is attributed to factors such as rapid urbanization and the adoption of sedentary lifestyles. According to the International Diabetes Federation, the number of adults with diabetes was approximately 426 million in 2017, and this figure is projected to reach around 635 million by 2045. Notably, China, India, the U.S., Brazil, and Mexico collectively represent 57.0% to 60.0% of the global diabetes population, with China and India accounting for 46.0% alone.

January 2023: LifeScan announced that the Journal of Diabetes Science and Technology, a peer-reviewed publication, released a study titled Enhanced Glycemic Control Utilizing a Bluetooth-Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Insights from a Cohort of Over 144,000 Individuals with Diabetes.

Contributing to this surge are additional factors like obesity and a lack of awareness, particularly in emerging economies. The World Health Organization reported that in 2016, an estimated 1.9 billion adults globally were overweight, with 650 million among them classified as obese. The confluence of rising obesity rates and a growing diabetic population is expected to drive demand for diabetes treatment, consequently fueling the growth of the diabetes management devices market in the forecast period.

Introduction of Novel and Technologically Advanced Products is One of the Key Drivers of the Diabetes Control Devices Market

The global diabetes devices market is experiencing substantial growth, driven primarily by the introduction of innovative products in diabetes monitoring systems and treatment devices. A notable example is the FDA approval granted to Tandem Diabetes Care, Inc. in February 2019 for marketing the t: Slim X2 insulin pump, the first of its kind with interoperable technology for both children and adults with diabetes. This insulin pump marked a significant milestone as the pioneer device classified under a novel de novo premarket review pathway.

Another instance of industry advancement is the partnership forged in January 2019 between Bigfoot Biomedical and Eli Lilly and Company. This collaboration aims to leverage artificial intelligence in developing solutions for optimizing insulin delivery and dosing.

Key market players are making strategic investments to address unmet needs, especially in emerging economies. In October 2018, Amazon entered the medical device arena, focusing on diabetes and cardiovascular disease. The launch of Choice, a new medical device brand, included blood glucose monitors and blood pressure monitors complemented by mobile apps offering features such as measurement tracking, data mobility, and reminders. Initiatives of this nature are expected to enhance public awareness and contribute to the increased demand for diabetes devices on a global scale, thereby propelling market growth.

Global Diabetes Control Devices Market: Market Trends

The continuous glucose monitoring is a Significant Trend in the Diabetes Control Devices Market

The Continuous Glucose Monitoring (CGM) segment is anticipated to experience robust growth, with an expected healthy growth rate of approximately 10.5% throughout the forecast period. To utilize a CGM system, a small sensor is inserted into either the abdomen or arm, featuring a tiny plastic tube, or cannula, that penetrates the top layer of the skin. The sensor is secured in place with an adhesive patch, facilitating continuous glucose readings day and night. Typically, these sensors are replaced every 7 to 14 days.

In March 2021, Roche introduced the Accu-Chek Instant system, featuring Bluetooth connectivity to the mySugr app for seamless transfer of blood glucose results. This system aligns with the company’s commitment to a patient-centered therapeutic approach, aiming to offer personalized diabetes management.

The functioning of continuous glucose monitoring sensors relies on glucose oxidase to detect blood sugar levels. Glucose oxidase converts glucose to hydrogen peroxidase, initiating a reaction with the platinum within the sensor and generating an electrical signal transmitted to the transmitter. Sensors play a pivotal role in continuous glucose monitoring devices, and advancements in technology aimed at enhancing sensor accuracy are expected to propel the growth of this segment during the forecast period. The market is witnessing the development of promising glucose-sensing technologies, including novel optical and other electrical glucose sensors, which contribute positively to overall market expansion.

Global Diabetes Control Devices Market: Market Restraining Factors

Stringent Regulatory Policies and Regulations is a Restraining Factor in the Diabetes Control Devices Market

Insulin pens and insulin pumps are diabetes devices that come with some drawbacks. As a result, before certifying a product for commercialization, regulatory organizations in various nations must identify potential dangers. Insulin pumps are primarily used to treat type 1 diabetes, although they can cause complications such as pump failure, insulin stability concerns, and infusion site issues.

As a result, the European Association for the Study of Diabetes (EASD) and the American Diabetes Association (ADA) will collaborate to assess device safety before they are approved for sale. Insulin pumps are Class IIb devices in the European Union (EU). As a result, manufacturers must submit a premarket notification before marketing these insulin pumps. To obtain market approval, this premarket notification must meet regulatory standards and demonstrate the safety associated with using these products.

Global Diabetes Control Devices Market: Segmentation Analysis

The market scope is segmented because of by device type, by distribution channel, by end-user.

By Device Type

Based on the device type of the market is segmented into Blood Glucose Monitoring Devices, Insulin Delivery Devices, Injection Aids, Others.

- Blood Glucose Monitoring Devices: In 2018, monitoring devices constituted the most significant portion of the global market for diabetes care devices. The substantial growth in the market can be attributed to a rising number of regulatory approvals granted for continuous blood glucose monitoring systems. Additionally, technological advancements in insulin delivery devices, including innovations like smart insulin patches, insulin inhalers, closed-loop pump systems, and other devices in the development pipeline, are key factors propelling the expansion of the global diabetes care devices market.

- Insulin Delivery Devices: In the global diabetes devices market, insulin delivery devices emerge as the most rapidly expanding segment, contributing to a share exceeding 56.0% in 2022. This category includes pens, pumps, syringes, and jet injectors, with pens dominating the market in 2022. Nevertheless, the pump segment is anticipated to experience significant market growth, with projections indicating it will achieve the fastest Compound Annual Growth Rate (CAGR) during the forecast period.

By Distribution Channel

Based on the distribution channel of the market is segmented into Hospital Pharmacies, Retail Pharmacies and Drug Stores, Online Pharmacies, Diabetes Clinics and Centers, Others.

- Hospital Pharmacies: In 2022, hospital pharmacies dominated the market landscape with a market penetration exceeding 59.3%, driven by substantial foot traffic and the wide availability of products. Within the hospital setting, two distinct types of pharmacies operate – the inpatient pharmacy and the outpatient pharmacy. The inpatient pharmacy, located within the hospital premises, is accessible exclusively to authorized personnel catering to operational areas such as operating rooms, ICUs, inpatient wards, and specialized service areas.

- Online Pharmacies: Online pharmacies, by directly sourcing diabetes devices from manufacturers, benefit from securing advantageous deals for their customers. The growth of this segment is propelled by heightened patient awareness regarding online pharmacies and augmented funding from both public and private sources.

By End-User

Based on end user the market is segmented into Hospitals and Clinics, Home Care Settings, Diagnostic Centers, Ambulatory Surgical Centers.

- Hospitals and Clinics: The hospital segment emerged as the market leader, commanding the largest market share at 45.9% in 2022. The escalating number of hospital admissions for patients with diabetes is a key factor propelling the demand for this segment. Individuals with diabetes face a threefold higher likelihood of hospitalization compared to those without diabetes. Over the past few years, there has been rapid evolution in diabetes technology, with many of these advancements specifically designed to enhance diabetes care within hospital and clinic settings.

- Home Care Settings: The homecare segment is poised to experience a robust compound annual growth rate (CAGR) of 7.8% during the forecast period, driven by the increasing emphasis on preventive care for diabetes. This growth is fueled by rising awareness initiatives undertaken by governments to promote knowledge about diabetes and the user-friendly design of insulin pumps, contributing to heightened demand for these devices in homecare settings.

As per the World Health Organization (WHO), 80% of the global elderly population resides in low- and middle-income countries. Projections indicate that by 2050, the worldwide population aged 60 and above will reach 2 billion. Consequently, these factors are fostering a surge in demand for insulin pumps in homecare settings, expected to witness exponential growth in the coming years.

Global Diabetes Control Devices Market: Regional Snapshots

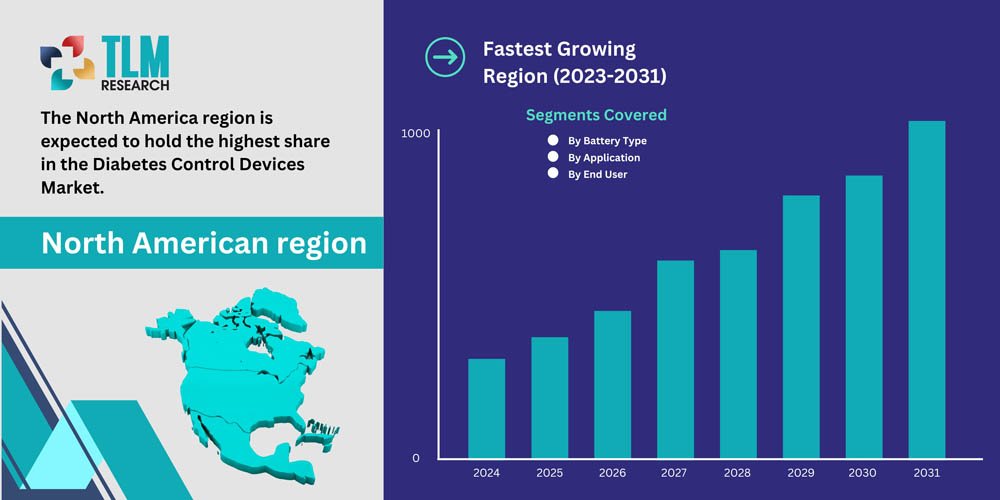

North America secured dominance in the market, accounting for a substantial revenue share of 39.88% in 2022 and is poised to continue leading with an anticipated compound annual growth rate (CAGR) surpassing 6.9% throughout the forecast period, primarily attributed to its well-established healthcare sector. Factors such as the escalating prevalence of obesity, the high cost of treatment, technological advancements, and continual product launches are expected to drive the region’s market growth.

Within North America, the United States emerged as the market leader, driven by a sizable diabetic population and favorable reimbursement policies. The high per capita income and increasing healthcare spending significantly contribute to the market’s expansion. In 2019, the American Diabetes Association reported an average estimated cost of USD 9,505.60 per person for diabetes-specific treatments. Diabetic patients in the U.S. may incur an overall medical expenditure close to USD 16,750 annually. The adoption of smart devices and technological advancements, including the integration of AI and data analytics, further propel market growth.

The Centers for Disease Control and Prevention’s (CDC) National Diabetes Statistics Report for 2022 revealed that over 130 million adults in the United States live with diabetes or prediabetes. Type 2 diabetes is more prevalent, particularly among communities of color, individuals in rural areas, and those with lower education, income, and health literacy levels.

Crucially, diabetes supplies are covered by the U.S. federal health insurance program, Medicare (Part B and Part D). This coverage includes various diabetic supplies such as blood glucose self-testing equipment, therapeutic shoes and inserts, insulin pumps, and the insulin used in the pumps. The availability of reimbursement options contributes to the widespread adoption of Diabetes Care Devices, as individuals often prefer health insurance plans covering a significant portion of their overall healthcare device expenditures.

Global Diabetes Control Devices Market: List of Companies Profiled

- Abbott Laboratories

- Medtronic plc

- Dexcom, Inc.

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- Ascensia Diabetes Care

- Becton, Dickinson, and Company

- LifeScan, Inc.

- Roche Diagnostics

- SOOIL Development Co., Ltd.

- Terumo Corporation

- Bigfoot Biomedical, Inc

- GlySens Corporation (U.S.)

Global Diabetes Control Devices Market: Key Industry Developments

- In October 2023, Dexcom launches the G7 CGM system, the first CGM system to be approved for paediatric use in the United States.

- In September 2021, Tandem Diabetes Care receives FDA approval for the use of its t: slim X2 insulin pump with the Dexcom G6 CGM system.

- In February 2023, Ascensia Diabetes Care collaborated with SNAQ to empower patients with diabetes to make mealtime decisions and improve the management of diabetes.

- In November 2022, Enjaymo (sutimlimab) was given the green light by the European Commission to treat adult patients with cold agglutinin disease who have hemolytic anemia.

- In November 2022, Ascensia Diabetes Care and Senseonics collaborated to provide both in-office and at-home insertion options for the Eversense® E3 Continuous Glucose Monitoring System. This collaboration with a Nurse Practitioner Group aims to boost patient access to Continuous Glucose Monitoring (CGM).

Global Diabetes Control Devices Market: Report Coverage

The report will cover the qualitative and quantitative data on the global Diabetes Control Devices Market. The qualitative data includes latest trends, market players analysis, market drivers, market opportunity, and many others. Also, the report quantitative data includes market size for every region, country, and segments according to your requirements. We can also provide customize report in every industry vertical.