The envelope shows up on a random day. You expect junk mail. Instead, it’s a medical bill; higher than you thought, higher than you planned for, and high enough to make you pause everything else for a minute. In that moment, most people realize they’re reacting to healthcare costs instead of controlling them. That’s where the real question begins: What are health savings accounts, and why didn’t anyone explain them sooner?

Medical debt is the leading cause of bankruptcy in America, yet billions of dollars sit unclaimed because people don’t understand what are health savings accounts. If you are looking for a way to turn unavoidable medical costs into a retirement goldmine, you have found it.

Health Savings Accounts weren’t designed as just another boring benefits checkbox. They were built for moments exactly like this, when health, money, and long-term security collide. Used correctly, an HSA turns medical expenses into one of the smartest financial tools you’ll ever touch. Used incorrectly, it’s just another missed opportunity hiding in plain sight.

The Triple Threat: Why the HSA Wins Every Time

Before we define the mechanics, you must understand the math. Most financial tools tax you at the beginning or the end. The HSA ignores the rules entirely.

When people ask, what are health savings accounts, they often miss the three-way tax savings:

- 100% Tax-Deductible Contributions: Every dollar you contribute lowers your taxable income. If you earn $60,000 and contribute $4,000, the IRS only sees $56,000.

- Tax-Free Growth: While your money sits in the account, it can be invested in stocks, bonds, or mutual funds. You pay $0 in capital gains taxes on the profit.

- Tax-Free Withdrawals: As long as you use the money for “qualified medical expenses,” you pay no taxes when you take it out.

Fidelity’s 2024 Retiree Health Care Cost Estimate suggests a 65-year-old couple will need roughly $165,000 to cover medical expenses in retirement. What are health savings accounts if not the most efficient bridge to reach that number?

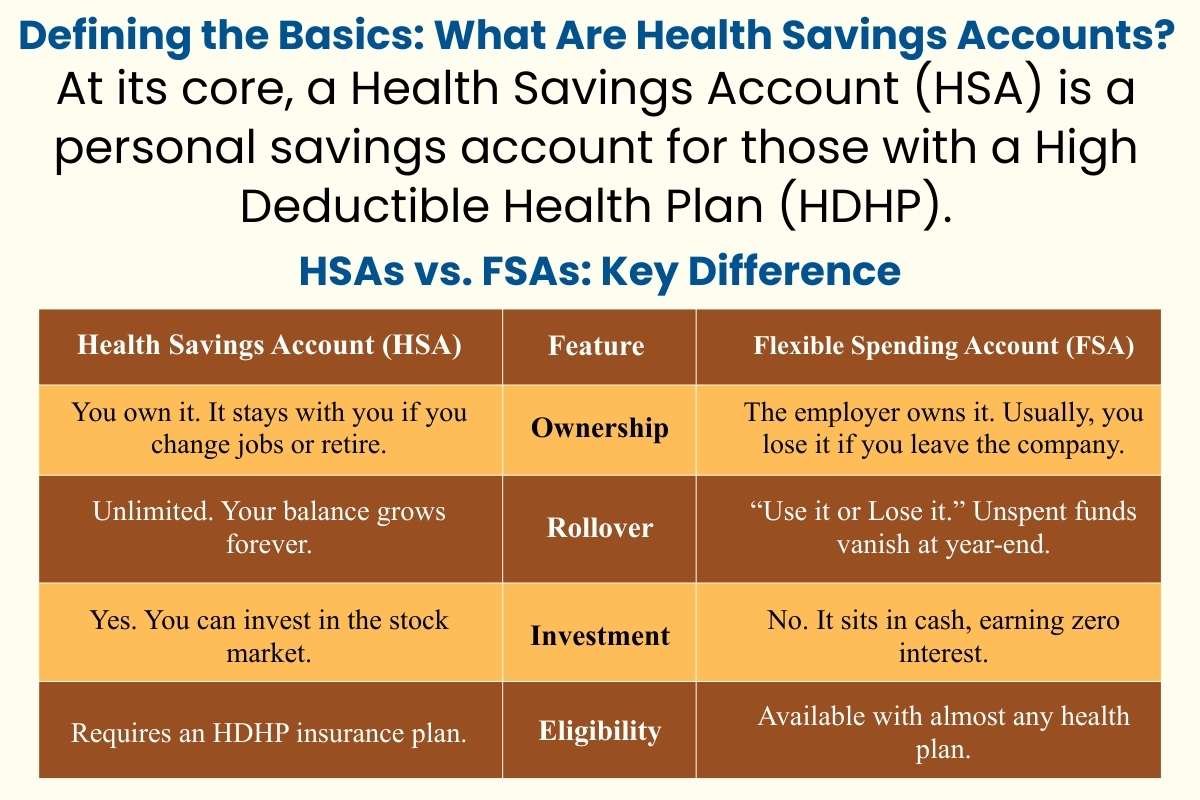

Defining the Basics: What Are Health Savings Accounts?

At its core, a Health Savings Account (HSA) is a personal savings account for those with a High Deductible Health Plan (HDHP). Unlike a Flexible Spending Account (FSA), the money in an HSA belongs to you forever. There is no “use it or lose it” trap.

HSAs vs. FSAs: Key Difference

One of the most dangerous mistakes employees make is confusing the HSA with the FSA (Flexible Spending Account). Understanding what are health savings accounts requires knowing why they are superior to FSAs.

| Health Savings Account (HSA) | Feature | Flexible Spending Account (FSA) |

| You own it. It stays with you if you change jobs or retire. | Ownership | The employer owns it. Usually, you lose it if you leave the company. |

| Unlimited. Your balance grows forever. | Rollover | “Use it or Lose it.” Unspent funds vanish at year-end. |

| Yes. You can invest in the stock market. | Investment | No. It sits in cash, earning zero interest. |

| Requires an HDHP insurance plan. | Eligibility | Available with almost any health plan. |

The 2026 IRS Rules You Must Know

To qualify for an HSA, your insurance plan must meet the definition of a High Deductible Health Plan (HDHP). According to the latest IRS Release (Rev. Proc. 2025-19), the rules for the 2026 tax year are more generous but strictly enforced.

2026 HSA Contribution Limits

This is the total amount you and your employer can put into your account combined:

- Self-Only Coverage: $4,400 (up from $4,300 in 2025)

- Family Coverage: $8,750 (up from $8,550 in 2025)

- Catch-up Contribution: If you are age 55 or older, you can add an extra $1,000 annually.

Pro Tip: If both you and your spouse are 55+, you can both do a catch-up contribution, but you must have two separate HSA accounts to do so.

2026 HDHP Requirements (HSA Eligibility)

Your health insurance plan must hit these specific numbers to be considered “HSA-compatible.” If your deductible is too low or your out-of-pocket maximum is too high, the IRS will disqualify your contributions.

| Metric (2026) | Self-Only Coverage | Family Coverage |

| Minimum Annual Deductible | $1,700 | $3,400 |

| Maximum Out-of-Pocket Limit | $8,500 | $17,000 |

The Hidden Power: Turning a Savings Account into an Investment Portfolio

Most people treat their HSA like a checking account. They put money in and immediately spend it on a co-pay. Senior financial advisors call this a “rookie mistake.”

The real magic happens when you pay for current medical bills out of pocket and let your HSA balance sit in the stock market. Because you don’t pay taxes on the growth, your money compounds significantly faster than it would in a standard brokerage account.

“The HSA is the only account in the U.S. tax code that provides a deduction for contributions and a tax-free distribution for both the principal and the earnings,” says Jean Chatzky, CEO of HerMoney.

When you truly grasp what are health savings accounts, you stop seeing them as “medical funds” and start seeing them as “Super IRAs.”

Qualified Medical Expenses: What Can You Actually Buy?

You might think the funds only cover surgery or hospital stays. In reality, the list of IRS-qualified medical expenses is massive.

- Routine Care: Vision exams, dental cleanings, and chiropractic care.

- Mental Health: Therapy and psychiatric care.

- Over-the-Counter: Since the CARES Act, you can buy menstrual products and cold medicine tax-free.

- Long-Term Care: You can even use HSA funds to pay for portions of long-term care insurance premiums.

Asking what are health savings accounts also means asking what they can’t do. If you spend the money on a non-medical expense before age 65, you pay income tax plus a 20% penalty. After 65, the penalty disappears, and it functions exactly like a traditional IRA.

How to Open and Invest Your HAS?

Step 1: Confirm Eligibility

Ensure you are enrolled in a qualifying HDHP. Check with your benefits administrator if you are unsure.

Step 2: Pick a Provider

Research features, fees, and investment options like robo-advisors. You can change providers even if you are no longer in an HDHP.

Step 3: Don’t Forget to Invest

Only 21% of participants invest their HSA assets, meaning most miss out on major wealth-building. Set up your investments to pay for long-term costs.

Consider Your Cash Needs

One way to manage your account is to set a “cash target”—the amount you keep uninvested to cover near-term expenses. A common strategy is to keep cash equal to your expected annual out-of-pocket costs or your deductible.

Investment Scenarios:

- Current Expenses: If you have upcoming procedures, increase your HSA savings to grow your cash balance while still investing. You can also pay small bills out-of-pocket and save your HSA for larger needs.

- Medical Emergencies: Use your HSA as a “rainy day” fund. Investing a portion can help this balance grow faster.

- Retirement Boosting: An HSA is often the most tax-advantaged retirement plan available. If you accumulate more than you need for health costs, you can withdraw funds for any reason after age 65 without a penalty (just income tax).

More on HSA Benefits

The financial advantages of HSAs are powerful:

- Tax-Deductible Contributions: Contributions are usually made with pre-tax income through payroll. If funded with after-tax dollars, you may take a tax deduction on your personal taxes.

- FICA Tax Savings: Payroll deductions lead to the most savings because they avoid Medicare and Social Security (FICA) taxes. For example, someone in the 22% federal bracket could save nearly 30% in total taxes on every dollar contributed.

- Employer Contributions: About 84% of employees with an HSA-eligible plan receive contributions from their employers—essentially a “401(k) match for your health”.

- Investment Potential: Investing your HSA can build a medical nest egg for later life. According to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover retirement health care.

- No “Use-it-or-Lose-it”: Funds carry forward indefinitely, allowing your savings to benefit from compounding returns.

- Ownership and Portability: Your HSA belongs to you, not your employer. You keep the money when you change jobs and can even have multiple HSAs.

- Best of Both Worlds: You can have an HSA and a limited-purpose FSA (for dental/vision) simultaneously if your employer allows it.

- No Penalty after Age 65: Starting at age 65, there is no penalty for using HSA money for non-medical expenses, though you will pay income tax. Before 65, non-medical withdrawals face a 20% penalty plus taxes.

- No Required Minimum Distributions (RMDs): Unlike 401(k)s or IRAs, you are never required to take funds out of your HSA, providing versatility in retirement planning.

Expert Tips for Maximizing Your Account

To truly master what are health savings accounts, follow these three rules from senior wealth managers:

- Automate Your Contributions: If your employer offers payroll deduction, use it. This avoids FICA taxes, saving you an extra 7.65% that you wouldn’t save if you contributed manually.

- Check Your Fees: Some banks charge “maintenance fees” that eat into your balance. Look for providers like HealthEquity or Fidelity that offer low-fee or no-fee investment options.

- Name a Beneficiary: Don’t let your hard-earned savings get caught in probate. Ensure your spouse is the beneficiary so the account remains an HSA after you pass.

Conclusion:

That unexpected bill from the beginning doesn’t have to be a crisis. When you understand what are health savings accounts and use them intentionally, healthcare stops feeling like a financial ambush and starts feeling like a plan. An HSA isn’t about today’s co-pay—it’s about future-proofing your life in a system where costs only move in one direction.

The difference between people who struggle with medical expenses and those who don’t is rarely income. It’s awareness. Open the account. Invest the balance. Let time and tax advantages do the heavy lifting. Because when the next envelope arrives—and it will—you’ll open it calmly, knowing you already planned for this moment.