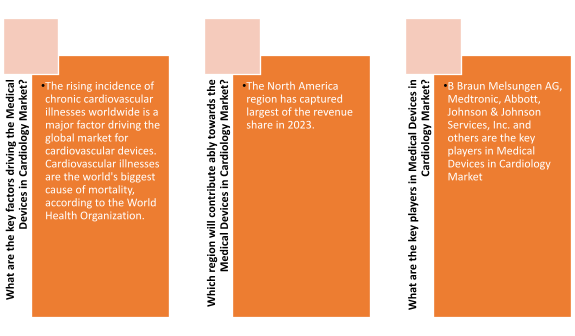

The global medical devices in cardiology market is substantial and continues to grow. Factors such as an aging population, increasing prevalence of cardiovascular diseases, and technological advancements contribute to the market’s expansion. Cardiovascular diseases (CVDs) remain a leading cause of morbidity and mortality globally.

Table of Contents

- Executive Summary

- Market Introduction

- Research Methodology

- Market Dynamics

- Market Factor Analysis

- Global Medical Devices In Cardiology Market, By Diagnostic And Monitoring Devices

- Global Medical Devices In Cardiology Market, By Therapeutic And Surgical Devices

- Global Medical Devices In Cardiology Market, By Region

- Competitive Landscape

- Company Profiles

Global medical devices in cardiology market: covid-19 impact

Many elective cardiac procedures, such as elective surgeries and non-urgent diagnostic tests, were postponed or canceled to prioritize resources for COVID-19 patients. This led to a temporary decline in certain cardiology-related medical device procedures.

Patients with chronic conditions, including cardiovascular diseases, faced challenges in accessing routine healthcare services due to lockdowns, fear of exposure, and overwhelmed healthcare systems. This had implications for the monitoring and management of cardiovascular health. The pandemic accelerated the adoption of telemedicine and remote patient monitoring, including for cardiac patients. Wearable devices and remote monitoring solutions gained prominence for managing chronic conditions and ensuring continuity of care.

Disruptions in the global supply chain affected the availability of medical devices, including those used in cardiology. The pandemic highlighted vulnerabilities in the supply chain and prompted discussions on building more resilient healthcare supply networks.

Global medical devices in the cardiology market:

Global medical devices in cardiology market: regional insights

Global medical devices in cardiology market: key market players

- Medtronic

- Abbott Laboratories

- Boston Scientific

- Edwards Lifesciences

- St. Jude Medical

- Biotronik

- Getinge

- Terumo

- W. L. Gore & Associates

- Lepu Medical Technology

FAQ’s